how long does coverage normally remain on a limited-pay life policy

The short answer to How Long Does the Coverage normally remain on a limited pay life policy is usually until age 100 or. Some prefer limited pay plans as they only have to pay premiums in their best earning years and wont have to worry about making payments while on a fixed retirement income.

Top 10 Best Dividend Paying Whole Life Insurance Companies 2022 Update

With a limited-pay plan you can pay off your little ones policy early so that he or she is covered forever.

. Limited pay life insurance is a type of whole life insurance policy that is structured to only owe premiums for a set number of years. Up to 150000 in coverage. How Long Does the Coverage Last on a Limited Pay Life Policy.

This type of life insurance covers you for as long as you live even after the premium payment period is complete. Ad Exclusive term life insurance from New York Life. How long does the coverage normally remain on a limited-pay life policy.

Guaranteed cash value grows tax-deferred. Its all about you. You may pay for your premiums monthly quarterly semi-annually or annually if you select to do so in a restricted time periodtypically 10 15 or 20 years.

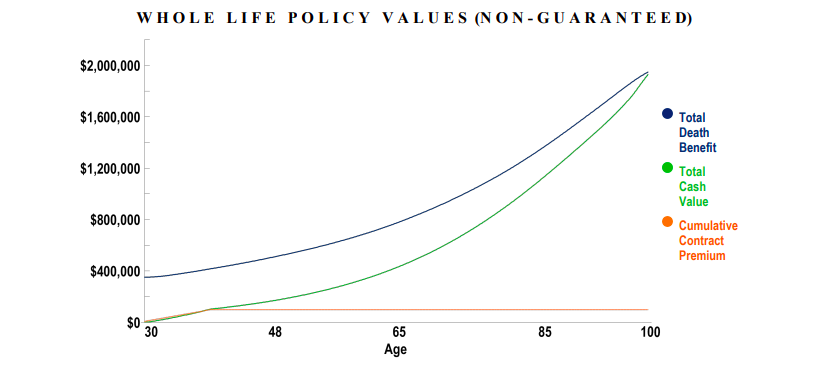

Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime. You can pay premiums monthly quarterly semi-annually or annually. If what you are looking for is cash value then check out our Top 7 Companies for Whole Life Insurance Cash Value article.

When a whole life policy matures the full death benefit minus loans and past due premiums is paid to the still living insured. Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime. Typically these types of policies are paid off in 10-20 years.

You can pay premiums monthly quarterly semi-annually or annually. If youre close to retirement age and are shopping for affordable life insurance a limited-pay life policy may be the best fit for you. Ad Get Instantly Matched with Your Ideal Life Insurance Plan.

A limited pay life policy allows you to pay off your life insurance in a set number of years. But a limited pay life policy allows you to avoid paying insurance premiums later in life. How long does the coverage last on a limited pay life policy.

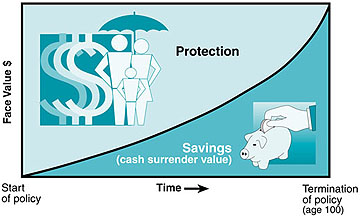

Guaranteed cash value grows tax-deferred. Even though the premium payments are limited to a certain period the insurance protection extends until the insureds death or to age 100. When a whole life policy matures the full death benefit minus loans and past due premiums is paid to the still living insured.

Life Insurance retirement Whole Life Insurance. In other words rather than paying your insurance premiums in perpetuity you agree to pay them in. Limited pay life insurance policies also have the potential to accrue a cash.

Which of these describe a. The Most Reliable Life Insurance Companies That Will Actually Cover Your Loved Ones. The coverage period for limited pay life policies is often a source of confusion.

On older policies that could be as low as age 95. Also the shorter the pay period the more faster you will accumulate cash value. Convertible term T would like to be assured 10000 is available in 10 years to replace the roof on his house what kind.

On new policies maturity is age 121. Age 100 Even though the premium payments are limited to a certain period the insurance protection extends until the insureds death or to age 100. On older policies that could be as low as age 95.

Limited PAY Whole Life means you pay it for 1020 years and the payment stops but the coverage lasts to maturity. Premiums are payable for 10 15 or 20 years depending on the policy selected. A limited-pay life policy is a type of whole life insurance policy that you can pay off in advance.

The quick answer to the question How Long Does Coverage Normally Remain on a Limited Pay Life Policy is usually until age 100 or until death. What kind of life insurance starts out as temporary coverage but can be later modified to come to coverage without evidence of insurability. Help protect your loved ones with valuable term coverage up to 150000.

In the short term this means your premiums will be more expensive than average. These limited pay life insurance policies allow you to pay your premiums for a set amount of time usually 10 15 20 or up to age 65 but you get continued coverage for the rest of your life. Premiums are typically paid over the first 10 to 20 years.

Limited PAY Whole Life means you pay it for 1020 years and the payment stops but the coverage lasts to maturity. 15 Pay Life A 15 pay whole life policy provides coverage that lasts your entire life with premiums due for 15 years. For example a 500k 10 year limited pay whole life insurance policy will cost more than a 500k 20 year policy.

When choosing the limited pay whole life option the payment length must be determined at the initial purchase of the policy. Premiums are payable for 10 15 or 20 years depending on the policy selected. Some people opt for this policy over a.

Reducing Costs for Retirement If youre within 10 or 15 years of retiring this kind of policy might be better than traditional whole life insurance. On new policies maturity is age 121.

Limited Pay Whole Life Insurance What Is It See The Numbers

Life Insurance Purposes And Basic Policies Mu Extension

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Limited Pay Whole Life Insurance Comprehensive Guide To The Best Policies With Sample Rates

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

International Life Insurance Plans For Expats And Global Citizens

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Whole Life Insurance Definition

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Understanding Universal Life Insurance Forbes Advisor

Limited Pay Whole Life Insurance Comprehensive Guide To The Best Policies With Sample Rates

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

What You Need To Know About Universal Life Insurance Pros And Cons

Whole Life Insurance What It Is And How It Works 2022

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

How To Reinstate A Life Insurance Policy That You Stopped Paying Forbes Advisor